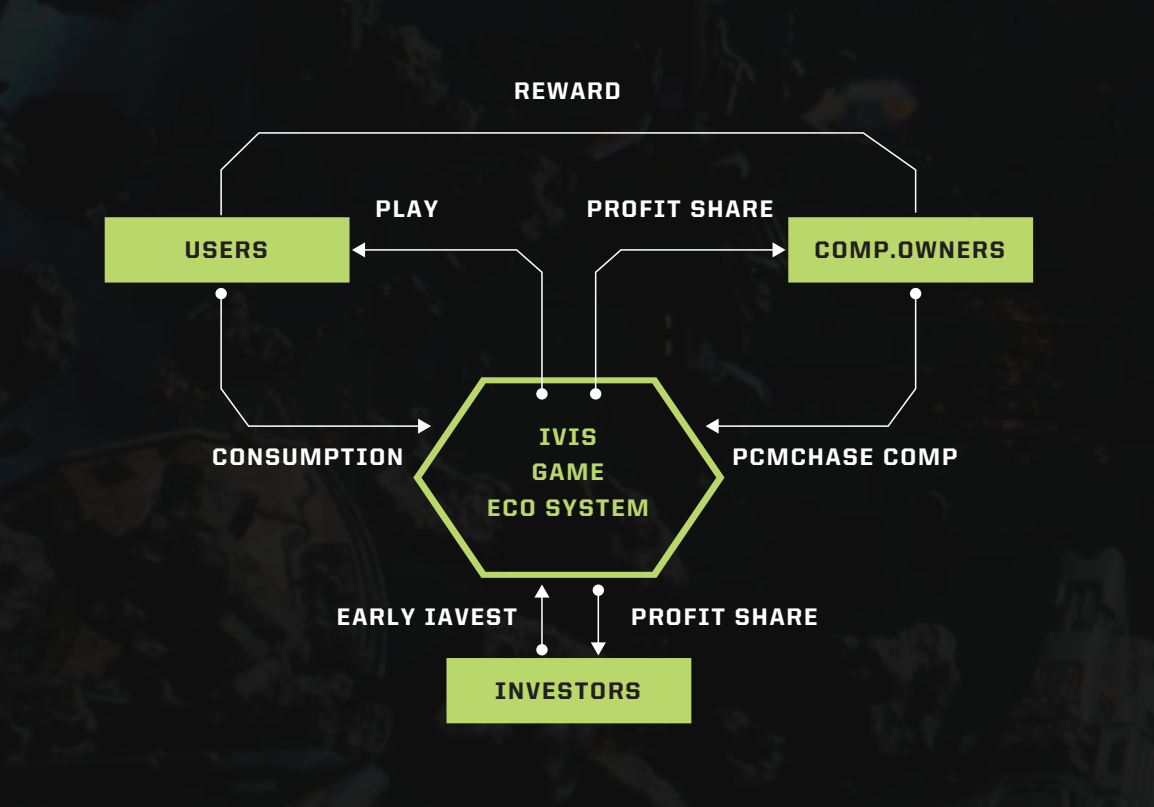

The economy structure of the IVIS ecosystem is centered around a single governance token, IVIS.

This token is universal across all games launched by the parent company and plays a crucial role in various aspects such as asset transfer between games, economic policy decisions, player rewards, and company (corporation) revenue generation.

This ensures that games across different genres, systems, and stages are integrated into one economic ecosystem, allowing players to have a comprehensive and flexible experience with a single token that spans the entire ecosystem.

Key Roles of IVIS Token

- Governance Token:

Holders of IVIS tokens can participate in governance procedures based on DAO (Decentralized Autonomous Organization), where they can vote on decisions related to game design, roadmap, economic policies, the introduction of new features, and more. This allows players and investors to act as decision-makers, not just consumers, and directly contribute to shaping the ecosystem’s direction and value creation structure. - Utility Token:

IVIS is used as a utility token in marketplaces, exchanges, and reward systems across all games. Players can trade NFT-based weapons, armor, equipment skins, planetary objects, and more using IVIS, creating value through the economic links between various games. This enables players to acquire rare assets or create tangible value across games. - Asset Transfer and Interchangeable Medium:

IVIS facilitates the free movement and exchange of assets (items, resources, real estate NFTs, etc.) across multiple games. This cross-game compatibility allows players to utilize the value of assets obtained in one game in other games, enhancing both token value and ecosystem vitality.